do pastors file taxes

Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

Does Your Pastor Really Have 99 Kids American Church Group Arizona

If you are a minister of a church your earnings for the services you perform in your capacity as a minister are subject to self-employment tax.

. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. For more information on ministerial income check. You must file it by the due date of your tax return for the second tax year in which you have net self-employment earnings of at least 400.

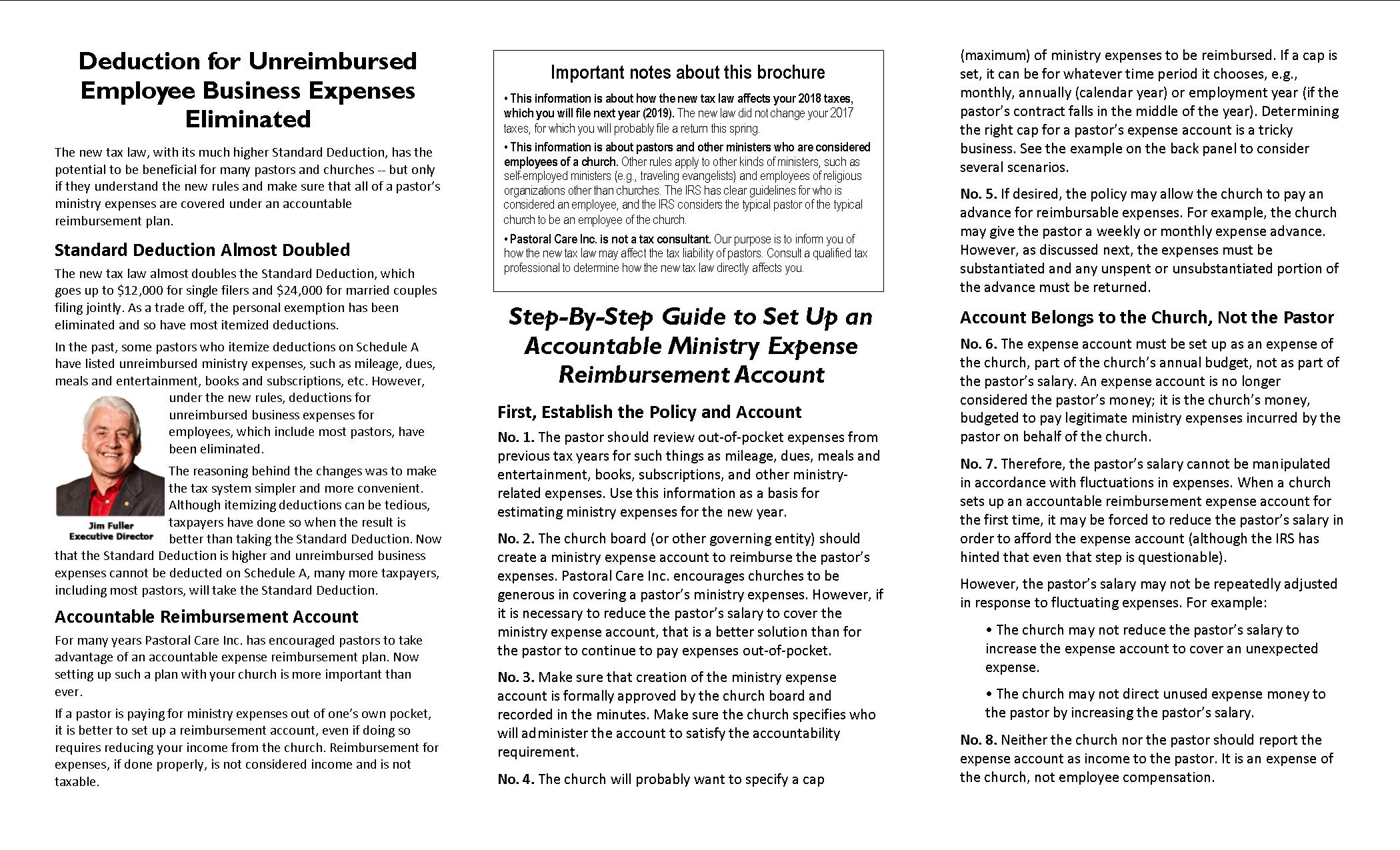

Yes and no While it is true that churches merely by the virtue of truly being churches enjoy tax-exempt status from federal corporate taxes that. They are considered a common law employee of the church so although they do receive a W2 their income is reported in different ways. Every year thousands of pastors overpay on their taxes because they are not aware of the IRS special.

In fact the real answer to this question is. This is not optional. It will file Form 990-T Exempt Organizations Business.

It all has to do with knowing the special rules that favor pastors. They must pay social security and. If excess housing allowance is taken it must be allocated as income.

Pastors may voluntarily choose to ask their. Pastors fall under the clergy rules. All pastors pay under SECA by law.

More In File For. Because the church has unrelated business income it must file a federal income tax return. Members of the Clergy Members of the Clergy For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare.

Ministers rabbis cantors priests and other religious officials who work as leaders of religious organizations are entitled to have some of their income excluded from taxation. How a ministers income is taxed. If a pastor earns a salary the IRS considers them to be a common-law employee and their wages are taxable for withholding purposes.

A pastors housing allowance is subject to SSFICA tax but not income tax. How do pastors file taxes. In short a minister must pay taxes like a self-employed worker but they are not eligible for all the tax benefits many self-employed workers enjoy.

With the 2018 tax changes the. How do churches file taxes. You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400.

The IRS considers any money pastors. Church employees are taxed under FICA unless their church opts out because they are opposed for religious reasons to the. A pastor may be unclear.

Church Pastor Under Vow Of Poverty Sentenced To Prison For 2m Tax Evasion Scheme

How Does Clergy Pay Estimated Taxes

Five Quick Tips For Clergy Taxes

History Of Churches And Taxes Procon Org

Church Clergy Tax Guide Clergy Financial Resources

Five Things You Should Know About Pastors Salaries Church Answers

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions

Pastoral Care Inc Minister Expense Form

Clergy Tax Guide Howstuffworks

2021 Clergy Tax Organizer Booklet Clergy Financial Resources

Q A How Churches Pastors Are Eligible For Relief In Stimulus Package Baptist State Convention Of North Carolina

Startchurch Blog 3 Major Tax Benefits For Pastors

The Right Way To Give A Bonus To Your Pastor Cbn Com

What Income Should Be Included On A Pastor S W 2

Ultimate Tax Guide For Ministers The Official Blog Of Taxslayer